Accounting Cycle Simplified: A Step-by-Step Guide for Businesses

Similarly, purchasing equipment might affect both the asset and expense accounts. Your next step is to make any adjusting journal entries necessary so your financial statements include relevant information for your working period. If you work for a business in the accounting department, you’ll quickly become familiar with the accounting cycle.

Reversing Entries: Optional step at the beginning of the new accounting period

The accounting period refers to the timeframe for preparing financial documents, varying from monthly to annually. Companies may opt for monthly, quarterly, or annual financial analyses based on their specific needs. The accounting cycle starts by identifying the transactions which relate to the business. The cycle includes only business transactions as the business is a separate entity to the owner.

Is it necessary to follow the accounting cycle?

This step is essential because it lays the foundation for future steps in the accounting cycle, such as posting to the ledger and preparing trial balances. It’s crucial to accurately record every transaction to avoid errors that could disrupt the entire full cycle accounting process. Accurately classifying each transaction into debits and credits ensures that the financial statements later reflect the true financial health of the business.

Step 2: Post transactions to the ledger

- Once all adjusting entries are completed, an adjusted trial balance is prepared to verify that the total debits still equal the total credits.

- This is a straightforward guide to the chart of accounts—what it is, how to use it, and why it’s so important for your company’s bookkeeping.

- Still, for small companies that don’t have a large volume of transactions, this can be achieved once a period.

- This process ensures that all financial data is appropriately categorized.

(e.g., an invoice you’re still waiting for a customer to pay or the bill from your supplier that hasn’t been paid yet). It makes sure your financial statements take future payments and expenses into account. You can then show these financial statements to your lenders, creditors and investors to give them an overview of your company’s financial situation at the end of the fiscal year. Meanwhile, the remaining five steps are the bookkeeping tasks you do at the end of the fiscal year. Fortunately, nowadays, you can automate these tasks with accounting software, so doing all this isn’t as time-consuming as it might seem at first glance.

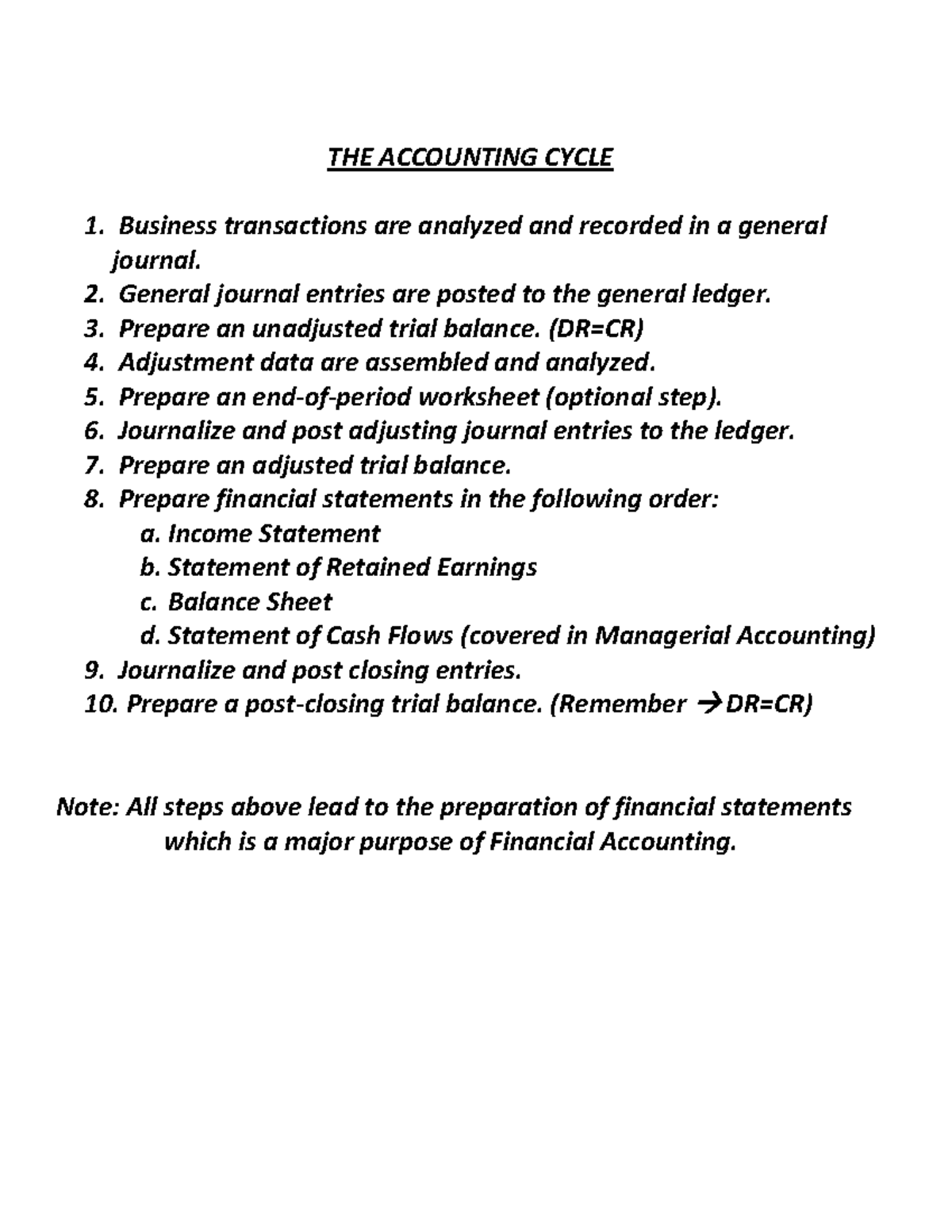

Finally, you need to post closing entries that transfer balances from your temporary accounts to your permanent accounts. Companies might employ multiple accounting periods, but it’s crucial to note that each period solely reports transactions within that time frame. If the accounting period extends to a year, it is also termed a fiscal year. Publicly traded firms, mandated by the SEC, submit quarterly financial statements, while annual tax filings with the IRS necessitate yearly accounting periods. From identifying transactions to preparing financial statements, the 8 steps in the accounting cycle ensure accurate record-keeping.

Time Value of Money

Skipping one could create inaccurate data and flaws within the entire financial reporting process, resulting in the business making ill-advised decisions. The total credit and debit balance should 10 steps of the accounting cycle be equal—if they don’t match, there’s an error somewhere. The unadjusted trial balance is the initial version of the trial balance that hasn’t been analyzed for accuracy and adjusted as needed.

Once you’ve made the necessary correcting entries, it’s time to make adjusting entries. If you use accounting software, this usually means you’ve made a mistake inputting information into the system. If you’re looking for any financial record for your business, the fastest way is to check the ledger. Next, you’ll use the general ledger to record all of the financial information gathered in step one.

A business document (such as sales invoice, official receipt, etc.) provides evidence that a particular transaction happened, and serves as basis in recording the transaction. In conclusion, preparing final statements is a crucial step in the accounting cycle, as it informs decision-makers about the financial performance and position of a company. The term indicates that these procedures must be repeated continuously to enable the business to prepare new up-to-date financial statements at reasonable intervals. Simply put, the credit is where your money is coming from, and the debit is what it’s going towards.

For example, all entries relating to sales are recorded in the sales account. Similarly, all transactions resulting in inflow and outflow of cash are entered in the cash account. The accounting cycle plays a crucial role in financial reporting by providing a structured and systematic process for recording, organizing, and presenting a company’s financial information. It ensures that financial statements are accurate, consistent, and comply with applicable accounting standards. The accounting cycle aids in effective decision-making, internal and external reporting, and regulatory compliance.